October 2014 Debt Update

/(*I am aware that this is personal. That people get squimish laying their money woes out for the world. For me, part of this process of having a healthier relationship with money, is being honest about where I am. To see my other posts on our money journey click here.) This will be my last post before I turn 30 and I think posting about our budget progress and setbacks is totally appropriate. We have been on Dave Ramsey's Financial Peace Journey for a year now. That is CRAZY. Time has flown, but we have also done SO much!

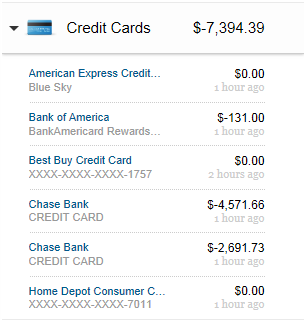

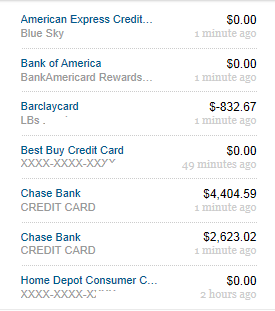

Our last debt update in September left us here:

Since that update we added LB's credit card with a balance of $-823.67, and the tires with a balance of $-1,466.19. So our total debt at the end of September was actually

September 2014: $-9,684.25

Half way through October, we have this much left:

October 2014: $-8,635.28

That means we paid off $1048.97 worth of debt last month AND TOTALLY paid off the Bank of America card! WOOT!

By halfway through November we are on track to pay off LB's credit card and the tires. *Adendum: after taking a cold, I-washed-my-hair-in-the-sink shower, I was reminded that our ER fund isn't fully funded again. We might readjust some of our debt payment this next month to get that beefed up.

GOAL BY MID-NOVEMBER: $-7027.61!

To really appreciate how far we have come in a year, I pulled our total debt number from our first Dave Ramsey workshop. BRACE YOURSELF!

Adding in LB's two debts, when we started we owed

$-17,000 in credit card debt alone!

To have that debt down to

$-8,635.28

Means that in the last year we have paid off

$8,364.72!!! In DEBT!

Woah. What a difference a year makes. What is AWESOME about this number is that while we were doing this we bought a house, fixed up and furnished said house, paid cash for our wedding, and generally enjoyed life. When I think about a year from now I know that I am going to have all this debt gone, my small student loan of about $5,000 paid off, and be making large payments on the truck to get that paid off. I also know that we will have started our FOR REAL emergency fund (3-6 months of living expenses in savings).

We've messed up. We've dipped into our honeymoon fund to cover things as we are still mastering our combined finances. LB still fights me on being totally transparent with his money, but is 90% on board 90% of the time. Considering he was 0% on board a year ago, I'll take it. It's not easy, this money stuff. It's easy to get discouraged and want to say F it. I love clothes and food as much as the next person, but I also keep envisioning what making that last credit card payment will feel like. (*HINT: AWESOME). I want to be free of debt. I want travel and try expensive resturants and be able to splurge on that coat/shoe/bag that I lust after. AND I WILL GET TO DO THOSE THINGS... once I've earned them.

Being an adult can suck sometimes, but you also realize that only through some of that suck will you get the thrill of seeing hard-earned progress. So go me. Go team.