September 2014 Budgeting & Debt Update

/(*I am aware that this is personal. That people get squeamish laying their money woes out for the world. For me, part of this process of having a healthier relationship with money, is being honest about where I am. To see my other posts on our money journey click here or explore our Being Thrifty tab)

Welcome back to positivity in budget land! Our immediate, post-wedding debt update was not all things happy. The wedding MUUUUUUUURRRRRRRRDDDDDEEEEEERRRRRRRREEEEEEEDDDDDDDD our budget. Did you get that? Murdered. So let's go back a few months.

*House of Bennetts tip: if you click the pictures of the debt breakdowns it will take you to that month's debt update post. It's like magic.

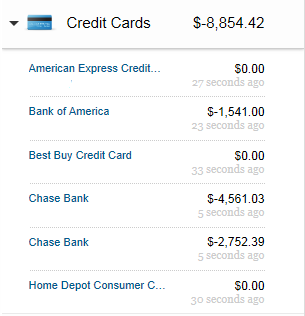

June:

August/Wedding/Murder:

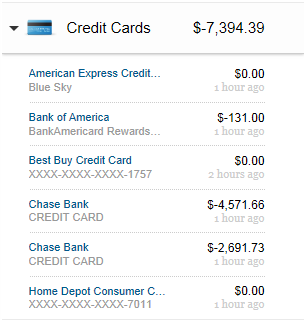

But NOW! Nearly half-way through September, we are moments away from crossing another credit card off of our list!

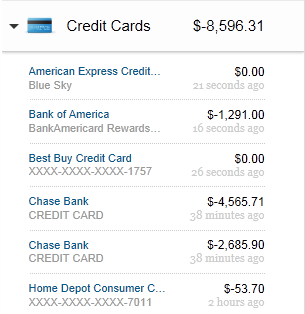

September:

Baaaaaaaaaaaaabam! So June through mid-September we have gone from

-$8,854.42

to

-$7,394.39!

which means with a wedding thrown in the middle of there, we have paid off

$1,460.03 in credit card debt this summer!

I've got my eye on you Bank of America credit card. Next week you are getting paid the heck off!

Now, confession time. We have to add a debt to our debt snowball. Back in June, before I rammed the truck into the side of a parking garage, and 6 measly weeks after we bought the damn truck, we had to get new tires for said damn truck. Said tires... well... those were $1600... yeah. We didn't want to empty the emergency fund and come up with $600 out of the wedding budget (because the wedding would not have happened if we did that) and so, we got no interest on the tires for a year and a half. Yeah. We sucked. That debt was LB's because cars/dudes domain. But now that we are fully combining EVERYTHING, it's our debt and is getting tossed into the pot. It is also, in fact, the next one up on the debt snowball. It stinks that we are having to delay tackling the big credit cards that are left, but we're both in this together. We dug this hole of ridiculousness and we've got to get out of it together... STAT.

I am doing some extra money making things this month: selling our old nightstands, babysitting, and helping out at a friend's wedding as a day of coordinator. That extra money is going to go straight towards replenishing our emergency fund and once that is full again, to the debt snowball.

I struggle a lot with this sense of entitlement. Yes. I forced myself to pay cash for our wedding. Yes. I saved and paid for our wedding. So good job me. BUT NOW, I want to charge a Tuff shed for the backyard because all of our yard and building supplies and tools are getting destroyed outside. (This is not an exaggeration). The shed out there is worthless. So what do we do? Do we charge it and add it to our debt snowball? Or wait a year and let more stuff get ruined while we save and pay for it? On this one, I truly don't know. I anticipate a lot of prayer time on this and any advice from you fellow budgeters is much appreciated. Since I don't ask for something before I give something, I am sharing this:

The list reminds me of my "Let it Be" re-post from a few weeks back. The moral of this update? I am still learning and struggling just like the rest of y'all. Trying to figure out how to do this life thing with a spender husband and my own sense of entitlement to stuff. Send us good vibes y'all... cause at almost 30, I still feel like a baby budgeter.