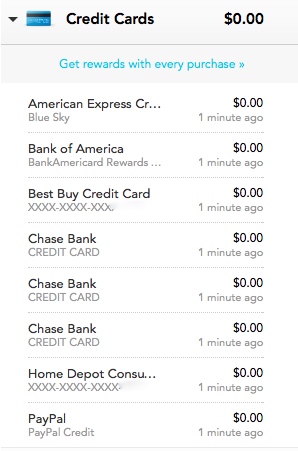

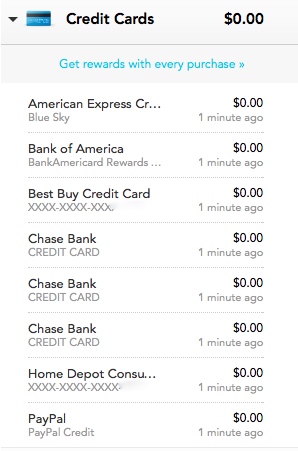

we are OUT of DEBT!!!!!!!!!!!!!!!!!!

/ Not ones to bury the lead.... WE ARE AT ZERO PEOPLE!

Not ones to bury the lead.... WE ARE AT ZERO PEOPLE!

ZERRRRRRRROOOOOOOOO!

When we first started FPU a year and a half ago, we had no idea how much it would change our lives for the better.

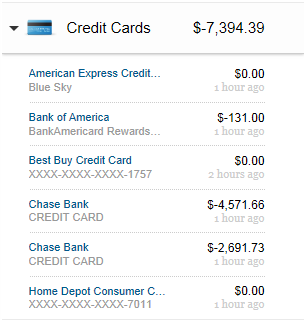

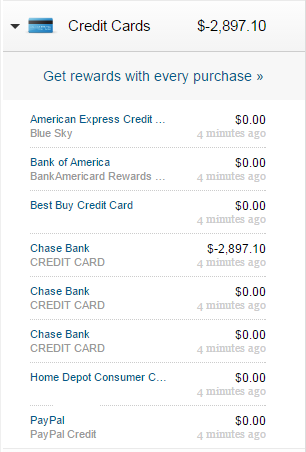

Basically, we started this debt-free journey we had

$-17,000 in credit card debt alone!

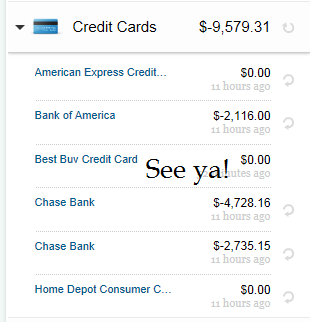

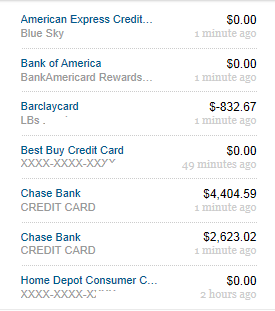

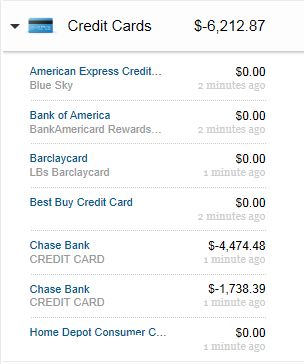

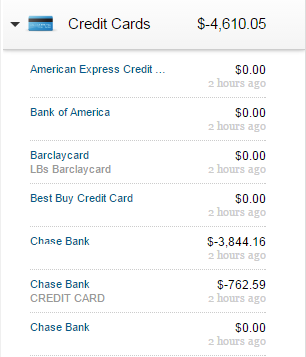

Let's just lay out all of the updates I've got from YIKES (November 2013) to now:

The total is weird here because we added in LB's debt with his credit card and the tires. So the total was $-8,635.28 as of October 2014.

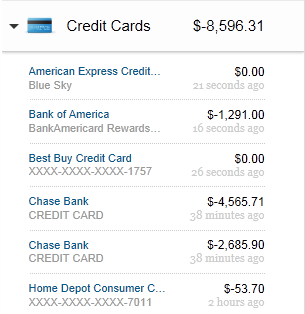

Beginning of May 2015:

AND NOW!!!

June 26, 2015: We Are Debt Free!

I share this to:

1. Brag

c. Be so darn proud of ourselves.

22. Make it VERY CLEAR that this stuff takes t i m e . So much slow progress and patience. So much forgiveness and stick-it-ive-ness. We have messed up so bad: the laundry room unexpected expenses, our wedding that we paid cash for, spending money on clothes and nonsense that we didn't really need, lacking patience with each other at times, holding ourselves to incredibly high standards and then beating ourselves up when didn't meet them... the list goes on.

x. This is hard work.

67. Encourage everyone in this: getting yourselves in a solid financial position and knowing that you are telling your money what to do is THE most important thing that you can do to remove stress from a relationship. Stress that actually isn't real and isn't about the other person. It is so much more about feeling out of control and taking it out on each other.

a. Remind myself that I never EVER want to be back there again. Being in debt was horrible and I am not interested in doing this again.

So go FORTH! Use the budgeting spreadsheet. Get on the same page with money. Ask questions. YOU CAN DO THIS!